Press Releases

Press Releases

Jeremy Hunt’s Autumn Statement saw him unveil a number of significant tax cuts – but there was a major caveat to today’s announcements that means Britons will face an eye-watering £44.6 billion tax burden.

Rishi Sunak announced a freeze of tax thresholds for four years in March 2021, which was extended by Jeremy Hunt until 2028.

The freeze means that taxpayers are being dragged into higher tax bands as their wages increase with inflation, a phenomenon known as “fiscal drag”.

According to the Office for Budget Responsibility’s report, published alongside the Autumn Statement today, the fiscal drag effect caused by the tax band freezes will cause four million additional taxpayers to pay income tax.

WATCH: Jeremy Hunt delivers his Autumn Statement

Three million more people will be pushed into paying higher rates of income tax, while 400,000 more will pay the top 45 per cent additional tax rate.

As a result of there being 68 per cent more taxpayers paying the 40 per cent rate, the Treasury will receive a total of £44.6billion by 2029 – when the OBR’s forecast comes to an end.

This represents an increase of £13.6billion since the OBR’s last forecast, published in March this year.

While Hunt’s statement today saw him announce a two per cent cut to the main rate of employee national insurance, the OBR’s report notes that frozen tax bands are “the largest contributor to the rising overall economy-wide tax burden”.

It also revealed that the UK’s tax burden is still on course to reach a post-Second World War high of 38 per cent of GDP.

“While personal and business tax cuts reduce the tax burden by half a percentage point, it still rises in each of the next five years to a post-war high of 38 per cent of GDP,” the OBR said.

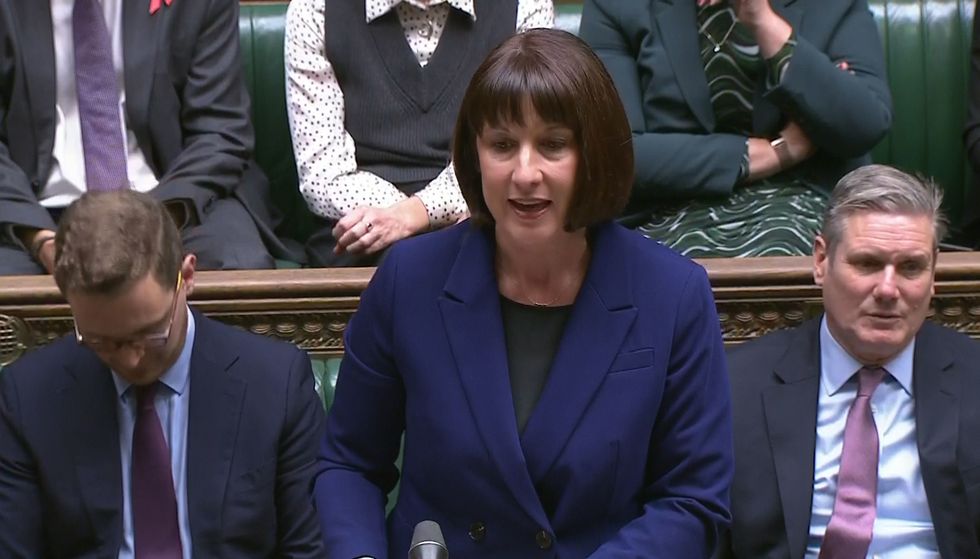

Labour’s Shadow Chancellor Rachel Reeves pointed out that taxes will be higher at the next election than they were at the last, telling the Commons that she has “long argued that taxes on working people are too high”.

The Shadow Chancellor also claimed that working people are “worse off” despite the Government’s promises.

Hunt announced a two per cent cut to the main rate of employee National Insurance, reducing it from 12 to ten per cent from January 6th. He also announced cuts to National Insurance contributions for the self-employed.

Opening his speech, the Chancellor boasted success on three key measures for the British economy, before going on to outline major tax cuts for Britain.

He claimed the Government is delivering on all three of the Prime Minister’s economic pledges, to halve inflation, grow the economy and reduce debt.

Hunt also told MPs that while the Government’s plan for the British economy is “working”, he warned: “The work is not done”.

He vowed the Government will “reduce debt, cut taxes and reward work”.

LATEST DEVELOPMENTS:

Rachel Reeves pointed out that taxes will be higher at the next election than they were at the last, telling the Commons that she has “long argued that taxes on working people are too high”

PA

Hunt told the Commons: “In today’s autumn statement for growth our choice is not big government, high spending and high tax because we know that leads to less growth, not more.

“Instead we reduce debt, cut taxes and reward work. We deliver world-class education. We build domestic sustainable energy.

“And we back British business with 110 growth measures – don’t worry, I’m not going to go through them all – which remove planning red tape, speed up access to the national grid, support entrepreneurs raising capital, get behind our fastest growing industries, unlock foreign direct investment, boost productivity, reform welfare, level up opportunity to every corner of the country, and cut business taxes.”

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com