Press Releases

Press Releases

National Insurance is reportedly set to be slashed again in a move which will save the average British worker close to £449 a year.

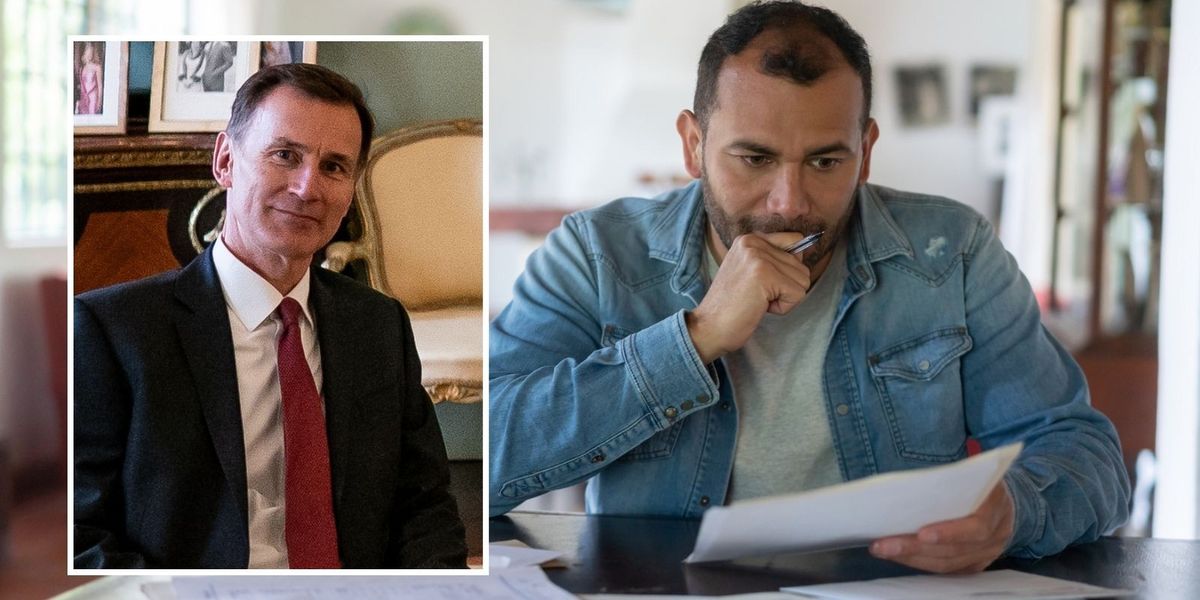

Chancellor Jeremy Hunt will announce the levy will be reduced by a further two percentage points for 27 million workers in tomorrow’s Spring Budget, The Times reports.

However, reports suggest this rumoured change to National Insurance means an income tax cut is off the table.

The Times claims Mr Hunt will suggest the rate reduction is worth a total of £900 for the average worker.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Jeremy Hunt is reportedly preparing to cut National Insurance once again

GETTY

This figure takes into account the two percentage point cut that was announced in the Chancellor’s Autumn Budget last year.

Analysis carried out by HW Fisher found that a reduction in the main rate of National Insurance would mean a saving of £448.60 next year for someone earning £35,000.

However, due to tax thresholds being frozen until 2028, taxpayers are set to see their tax burden increase.

Sam Dewes, a tax partner at the accountancy firm, suggested that Jeremy Hunt has few options available to him ahead of the Budget.

He explained: “It appears the Chancellor has limited room for broader tax give-aways, potentially viewing National Insurance cuts as a more affordable option for the Government by targeting workers, rather than cutting income tax instead.

“However, any benefits of a two per cent National Insurance cut will be capped at £754 per year for workers above £50,270 unless adjustments are made to the upper National Insurance rate.

Mr Dewes noted there has been no reference to cutting the rate of employer’s National Insurance contributions which sits at 13.8 per cent.

Furthermore, the tax expert questioned how effective another cut to National Insurance will be due to the impact of fiscal drag.

Mr Hunt is under pressure to help families with the cost of living in tomorrow’s Budget

GB News

This the term used to describe when tax allowances do not keep pace with either wages or inflation which results in people paying more of their hard-earned cash to HM Revenue and Customers (HMRC).

“The absence of discussions on increasing allowances and thresholds hints at persistent fiscal drag, which is likely to further increase the overall tax burden which is already at its highest since World War II,” Mr Dewes said.

“Consequently, while some workers may experience reduced National Insurance contributions, the broader tax framework is poised to continue exerting significant pressure on taxpayers, and many will end up paying an increased tax rate overall by being pushed into higher tax brackets.”

Mr Hunt will reportedly announce the changes to National Insurance during the Spring Budget on March 6.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com