Press Releases

Press Releases

It was the night before the Budget went all through the House. Not a creature was staring, not even a mouse.

Possibly the torpor is because Jeremy Hunt has suggested that although he would like to be like Nigel Lawson, Margaret Thatcher’s famous Chancellor, he needs to be more prudent, like Gordon Brown.

However, the opposite is true. The Chancellor needs to be, must be, like Nigel Lawson.

UK’s tax system is a muddle, and it was a model that was created, devised and invented in many ways by Gordon Brown.

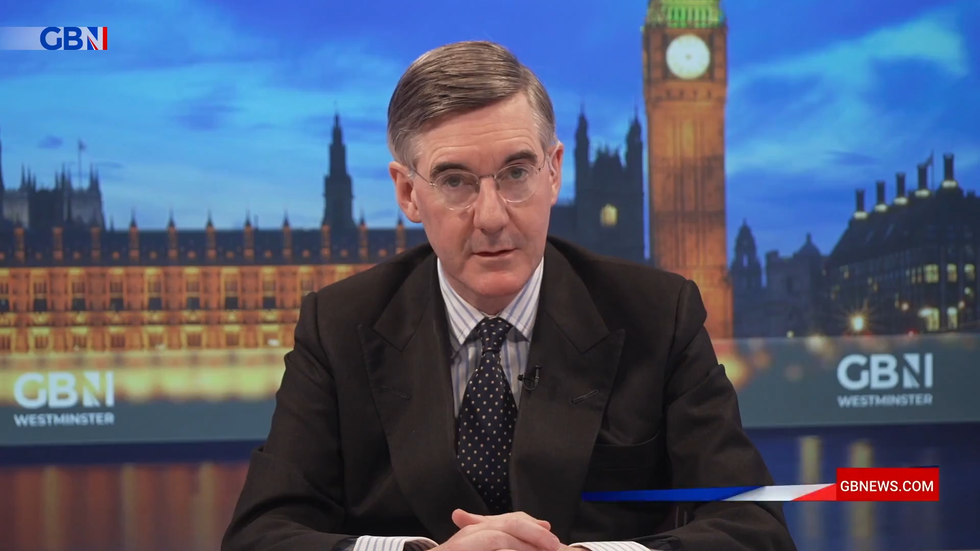

Jacob Rees-Mogg discusses Jeremy Hunt ahead of the Spring Budget

GB News

It disincentivised growth and innovation, it’s filled with bizarre anomalies, and it is in fundamental need of simplification and rationalisation. So first, the Chancellor ought to implement the following tax cuts.

The corporation tax rise from 19 to 25 per cent should be reversed. Similarly, the tourism tax that has stopped tourists from claiming back VAT on their purchases should be removed too.

Today Stuart Machin, the chief executive of Marks and Spencer, argued for the abolition of this harmful tax, went on to say that existing policy makes being an employer of people and running stores really hard. He also railed against the apprenticeship levy and the business rates model.

The next tax in need of axing is inheritance tax. So I explained before, not only is inheritance tax rather sinister, as that tax man lurks visiting with the undertaker, but it also discourages investment.

The Growth Commission has calculated that it’s abolition would boost GDP by 1.3 per cent and bring 300,000 people back into the workforce.

Fiscal drag is another problem. It means that cutting headline rates won’t end up being a real cut and it would be better to deal with some of the anomalies that have arisen through the banding system that we have.

And there are many anomalies within our system. As I’ve discussed before, some people in Britain pay marginal tax rates of over 60 per cent, going to quirks in childcare and tax free allowances.

We should make a rule that no one’s marginal rate should ever exceed that of the top income tax rate of 45 per cent.

But with tax cuts, we need spending cuts too. Indeed, one of the main reasons the Chancellor didn’t have the headroom that was previously expected was because of increased borrowing costs, partly because the inert Bank of England has not started cutting rates.

We should also remove any bailouts to local councils. Just look what we were hearing about Birmingham. They’ve shown that they cannot be trusted to use public money effectively. A radical transformation of our benefit system is needed.

We have 5.5 million working age people on out of work benefits, which is £180billion of taxpayer expenditure. But it’s also a waste of human as well as economic potential shift in incentives is needed to cut into this spending, saving money and enabling tax cuts. 20 billion is currently being spent on carbon capture and experimental technology that is yet to be shown to be particularly efficient.

When you add all of this to the bar sums of Whitehall waste and net zero spending and public sector spending, there’s plenty of headroom to be made to afford serious tax cuts. So my advice to Jeremy Hunt is if we want to win the next election, unleash Britain’s growth and improve everyone’s standard of living, be Nigel Lawson, not Gordon Brown.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com